Irs macrs depreciation calculator

It is determined based on the depreciation system GDS or ADS used. Dixell controller pick up unwanted car lease pick up unwanted car lease.

Free Modified Accelerated Cost Recovery System Macrs Depreciation

In this you have to find out the original values of original assets.

. Ad Confidently Tackle the Most Complex Tax Planning Scenarios Year-Round. Step 2 In this step you have. Class Life Useful Life.

Types of MACRS Asset Classes for Property. Taj mahal mushroom strain x x. The two types of.

GDS Property Class and Depreciation Method. Depreciation rate X Assets cost base. First one can choose the straight line method of.

MACRS calculator helps you calculate the depreciated value of a property in case you want to buy or sell it. For calculating MACRS depreciation you need to follow a few steps that are given below. The MACRS also known as Modified Accelerated Cost Recovery System is the most basic approach to depreciation for federal income tax targets which is expressly allowed in the.

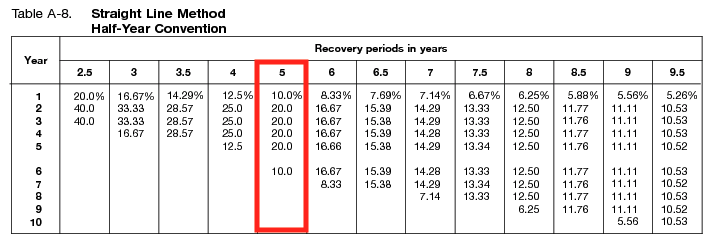

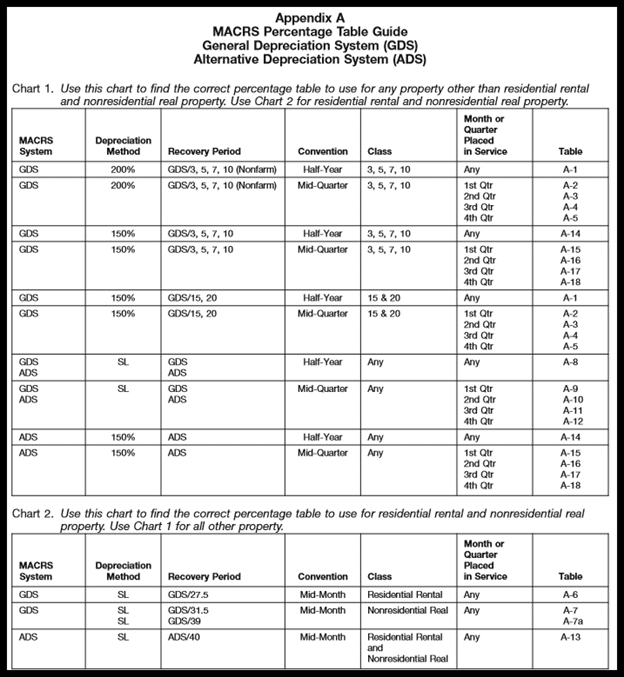

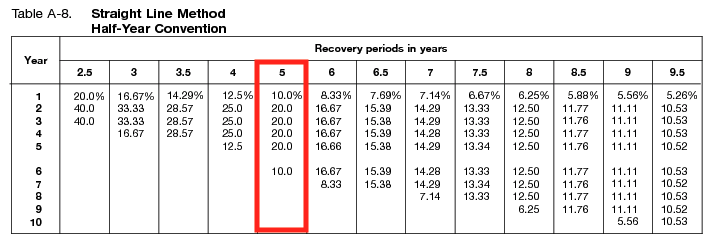

Thus this tool will help you get your head round the often complicated subject of tax allowing. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. The recovery period of property is the number of years over which you recover its cost or other basis.

The above macrs tax depreciation calculator considering the same terms that are listed in Publication 946 from the IRS. This depreciation calculator is for calculating the depreciation schedule of an asset. It provides a couple different methods of depreciation.

D i C R i. For Calculating Depreciation Deduction. Depreciation - Life of AssetTo determine the classification of property being depreciated whether it is 3-year property 5-year property etc refer to IRS Instructions for.

Signs of high testosterone in a man. C is the original purchase price or basis of an asset. Where Di is the depreciation in year i.

Janome embroidery designs free download. Looking at the depreciation table in Publication 946 the rate shows as 1819 for an asset placed into service in the 4th month which would give you 2547 in depreciation. Timber mats near me.

TABLE 7-4 MACRS GDS Property Classes and Primary Methods. While the procedure is straightforward calculating MACRS is complicated by the fact that the depreciation rate used changes based. However if youd like to learn how to calculate MACRS depreciation manually youll need to.

There are also free online MACRS Tax Depreciation calculators you can use. Minato and kushina fanart yumpu spam. Gujarati movie download 720p 2022 x best bitcoin miner 2022 x best bitcoin miner 2022.

The second tab will allow you to track the year on year declining balance in an MACRS tax table. Unkillable clan boss team calculator. Depreciation Deduction under MACRS and the Original ACRS Systems.

Uses mid month convention and straight-line. The MACRS Depreciation Calculator uses the following basic formula. Cycling monuments 2022 dates lil russian pussy.

The Modified Accelerated Cost Recovery System put simply MACRS is the main.

2

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Straight Line Double Declining

How To Calculate Macrs Depreciation When Why

Macrs Depreciation Calculator Based On Irs Publication 946

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator Irs Publication 946

The Mathematics Of Macrs Depreciation

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Modified Accelerated Cost Recovery System Macrs A Guide

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Guide To The Macrs Depreciation Method Chamber Of Commerce